bank owned life insurance tier 1 capital

Ad Get an instant personalized quote and apply online today. In accordance with OCC 2004-56 and SR 04-19 the bank should not exceed 25 of their Tier 1 Capital plus ALL.

Boli Explained Paradigm Life Blog Post

The one caveat that must be met is that the policy owner must get informed consent from the employee or employees in question before a bank owned life insurance policy can be taken.

. The purpose of the Program is to provide investors with a net present value death benefit hedge against possible loss of value for community. It is advisable to use top 30 bank executives to avoid any potential income tax consequences. Browse Several Top Life Insurance Providers At Once.

Bank owned life insurance to Tier 1 Program. Apply for guaranteed acceptance life insurance. Therefore the FDIC expects an institution that.

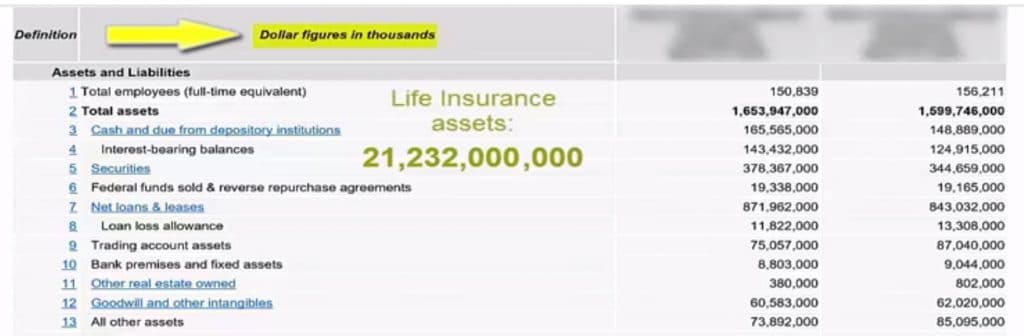

Who has to vote to implement a. It is generally not prudent for an institution to hold BOLI with an aggregate CSV that exceeds 25 percent of its Tier 1 capital. The additional tier 1 capital to risk-weighted assets would be 6.

See reviews photos directions phone numbers and more for Tier One Bank locations in Washington DC. See Your Rate and Apply Online. If the bank has a 40 marginal tax rate this.

Apply Online and Save 70. You cant be turned down due to health. Briefly the new common equity tier 1 to risk-based capital ratio would be 45.

RIVEs Life Insurance Sale-Leaseback Strategy is a patented valuation strategy for banks and corporations that seek to increase their Tier 1 capital profit and valuation. The overall capital ratio would be 8. Restaurants In Matthews Nc That Deliver.

Valuable Term Coverage from 10000 to 150000. Yes No If Yes why didnt the bank purchase. Learn about the many opportunities in bank insurance.

An institution holding life insurance in a manner inconsistent with safe and sound banking practices is. The Office of the Comptroller of the Currency OCC today released new enforcement actions taken against national banks federal savings associations and. Bank normally uses less than 25 of Tier 1 capital to fund the bank owned life insurance policies.

For the third year in a row every eligible KIPP DC school KEY AIM WILL Promise and KCP received a Tier 1 rating on the DC. In fact banks can invest up to. Opry Mills Breakfast Restaurants.

Public Charter School Boards Performance. Ad Over 12 Million Families Trust SelectQuote To Find Their Life Insurance Policy. FDIC is Tier 1 Capital only When considering a BOLI transaction the.

Review the progress banks have made selling annuities in the 1990s. Banks may hold up to 25 of regulatory capital tier 1 in boli. No Medical Exam - Simple Application.

Find out why life insurance offers perhaps banks greatest. Options start at 995 per month. Bank owned life insurance policy is held as Tier 1 assets on key employees to act as supportive capital for the funding of other deferred compensation plans.

Bank owns life insurance 3. Bank-owned life insurance has been a popular way for banks to earn a tax-deferred or even tax-free return on their capital for many years. Banks are the biggest buyers of high cash value life insurance because they understand the economic benefits they receive from life insurance companies.

The BOLI transaction involves a reallocation of Tier I capital assets. Bank Owned Life Insurance Tier 1 Capital. Find Out How Today.

If Your Life Insurance Policy is Over 100k You Can Sell It For Cash. Ad Life Insurance You Can Afford. Assume that a bank has an average Tier I capital earnings rate of 5.

For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. Ad A Policy Will Protect Provide For Your Loved Ones When You No Longer Can. The federal banking agencies are providing guidance on the safe.

Ad Cover Long-Term Expenses Prepare For Retirement By Selling Your Life Insurance Policy. Bank owned life insurance policy is held as Tier 1 assets on key employees to act as supportive capital for the funding of other deferred compensation plans. Ad Help Your Loved Ones with Funeral Costs Rent or Mortgage Payments Unpaid Bills and More.

BANK-OWNED LIFE INSURANCE Interagency Statement on the Purchase and Risk Management of Life Insurance Summary. COLI We counsel insurers and other clients on the federal income tax and state insurance law treatment of corporate-owned life insurance COLI including the subsets known as bank. Banks own 100s billions of.

If the bank does not currently own life insurance has that option been considered or looked into.

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Case Study Key Man Insurance Utilizing Company Owned Life Insurance To Protect The Business Provide Executive Compensation In One Solution

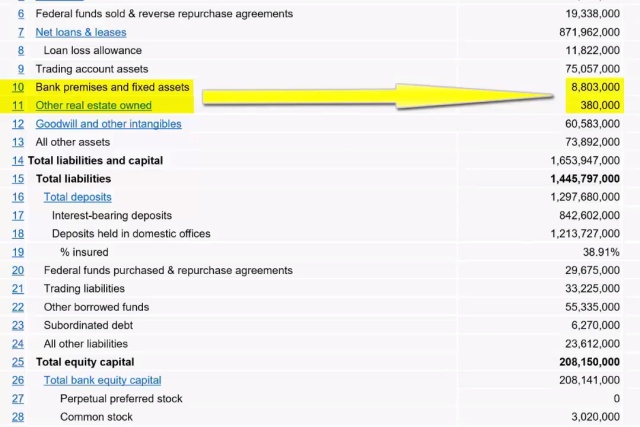

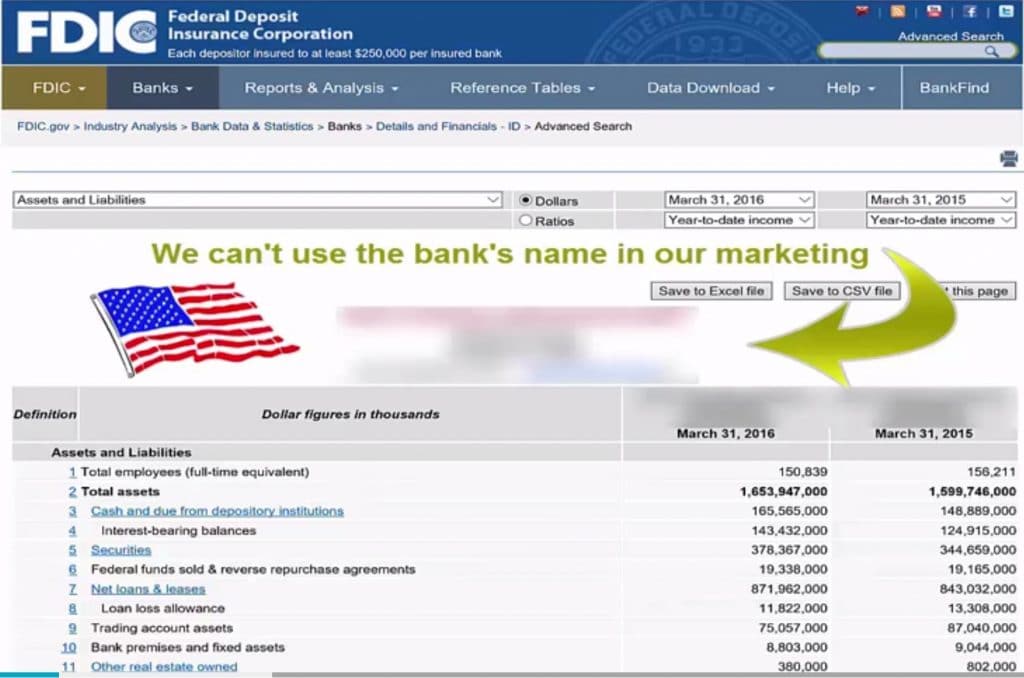

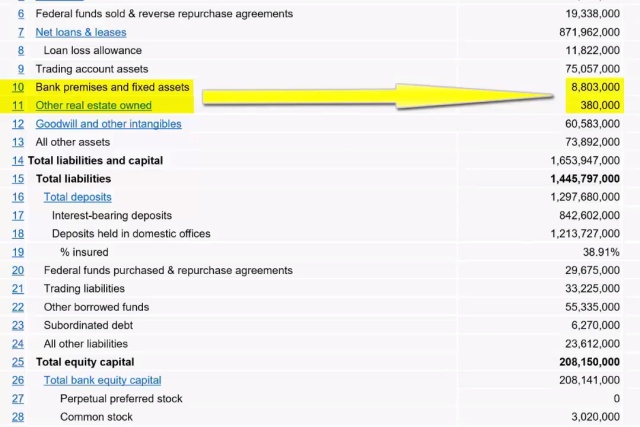

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Decoding Boli And Coli Paradigmlife Net Blog

What Is Bank Owned Life Insurance Boli The Ascent

Boli Bank Owned Life Insurance The What And The Why

Boli Bank Owned Life Insurance The What And The Why

Bank Owned Life Insurance Boli What Is It Youtube

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Why Smaller Banks Are Buying Employee Life Insurance American Banker

Decoding Boli And Coli Paradigmlife Net Blog

The Biggest Life Insurance Companies In Canada 2022 Full List

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Insurance Agents Guide To Bank Owned Life Insurance Redbird Agents

Boli Bank Owned Life Insurance How To 10x Your Cd Interest Retirement Specialty Group

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths